So, you’re sold on the idea of 300 days of sunshine per year?

Mountains on one side and the sea on the other? Incredible food and culture? The list of reasons to live on the French Riviera is endless.

To help make your move to the French Riviera as seamless as possible, we created this resource which gives detailed information on everything you need to know.

From simple details like getting a mobile phone, to buying property in France, and what taxes you’ll need to pay, this guide covers it all. Use the navigation below to quickly view each section.

Quick navigation

1. Getting residency in France

2. Opening a bank account

3. Learning French

4. Find your new home

5. Interior Designers

6. Get some new wheels

7. Driving in France

8. Getting to know the area

9. Getting around

10. Healthcare in France

11. International Schools

12. Doing Business

13. French Taxes

14. Finding Staff/Workers

15. Conclusion

16. Map of places to live

Getting residency in France

First things first, the right for you to live or work in France depends on your citizenship. Here’s a brief overview of how to get residency dependent on your current status.

1. You’re a non-European Citizen

If you are a non-European citizen staying in France for longer than three months, you’ll need what’s known as a Carte de Séjour, also known as a Titre de Séjour. The long-stay visa must be applied for before you leave your current home.

2. You’re a European Union (EU) and European Economic Area (EEA) Citizen

If you are a European citizen, you and your family members (rules apply for family) have the right to live and work in France. You won’t need to obtain residency or a work permit unless you are from Croatia.

3. New European Accession countries

Croatian nationals are welcome to live in France but need a work permit and residency permit.You can speak to the French Embassy in Croatia to seek advice.

For more information on getting residency in France, take a look at this resource: Angloinfo.

Opening a bank account

There are several good banks to choose from in France.

High Street Banks

- Société Générale

- Crédit Agricole (CA)

- BNP Paribas

- Caisse d‘Epargne (CE)

- Banque Populaire (BP)

- Crédit Mutuel

- La Banque Postale

- LCL

There are also various online-only banks such as ING Direct, Axa Banque, Groupama, BRED and Monabanq.

Picking the right one isn’t an easy task as they all have different offerings and benefits. What’s important is to make sure you choose a bank which has an office close to your new home on the French Riviera.

Drop in at your local branch and ask to set up a meeting so you can open an account. Some of the staff may not speak English so it’s a good idea to learn a few relevant phrases before you go, or take someone who speaks French with you.

If you’re looking for a private bank, take a look at these options: Private Banks

Documents to take with you

- Passport or some other proof of identity

- Proof of address in France (recent bill for example)

- Proof of employment or business ownership

- Proof of income

Learning French

First things first, moving to a foreign country is much easier if you can speak the lingo. Many locals on the French Riviera speak English, but it goes a long way if you make the effort to communicate in the native language.

Try and learn some French before you arrive by using the resources below.

Once you arrive in France, find a private tutor, speak to the locals and attend meetups like Franglish. That way you’ll be conversing in no time and you’ll get more out of living in France.

Find your new home

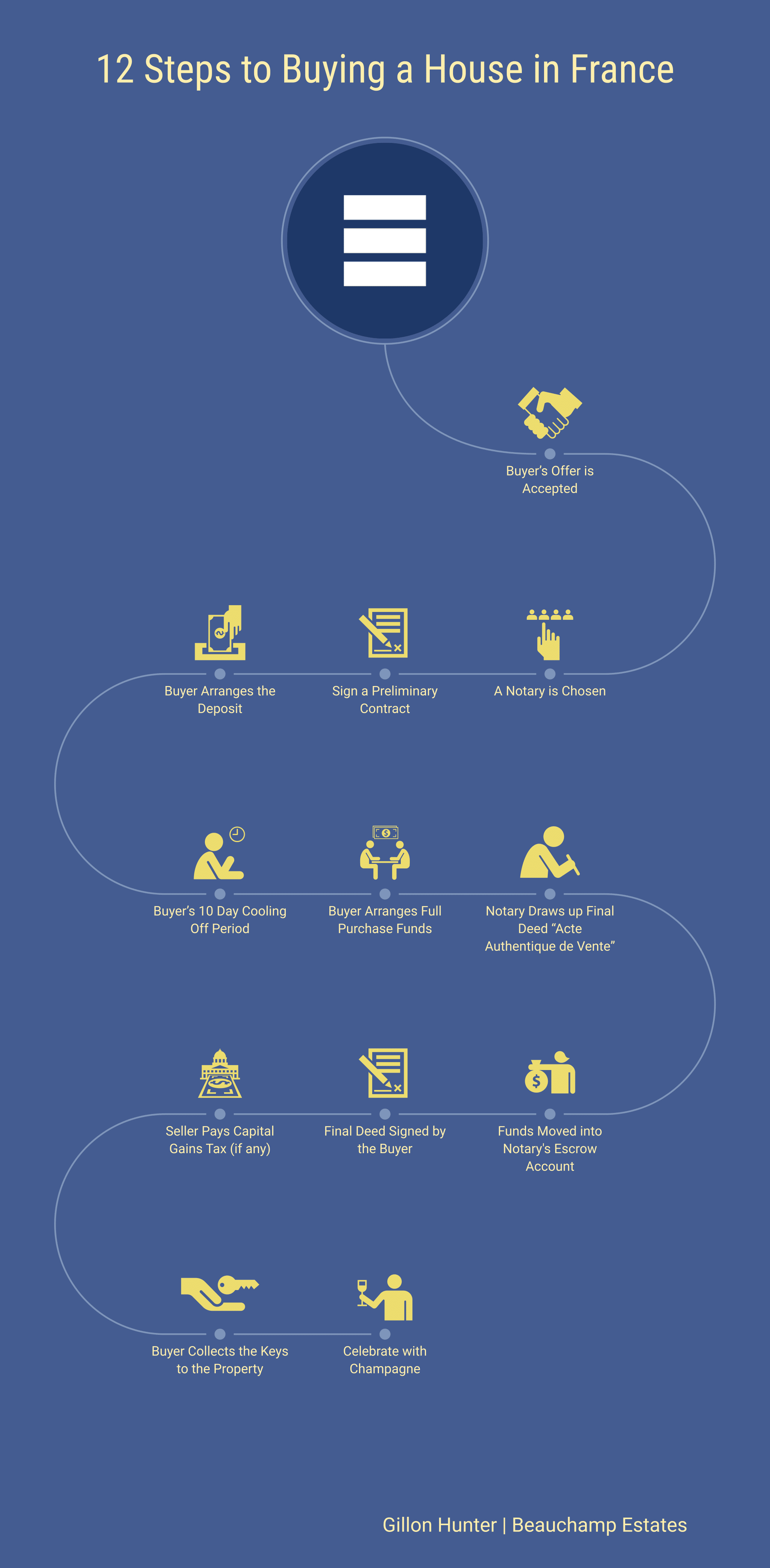

Buying property in France is a relatively straightforward process if you have the right people on your side. The expert team at Beauchamp Estates in Cannes will help you find the perfect luxury property on the French Riviera and guide you through the buying process.

You’ll find beautiful homes all along the coast from Monaco to St Tropez (including Provence and the Var). Prices range from €500,000 to €80 million. Take a look at the full portfolio below:

View the full guide: Buying Property in France.

Interior Designers

Now you’ve found your dream home, it’s time to furnish it and really make it your own.

Based in Cannes, Collection Privee is an architect and interior design firm who can advise you on how to optimise your living space. They also sell outstanding furniture and accessories which will help you get settled into your new home in no time at all.

Call into their show room which is on the same street as Beauchamp Estates in the centre of Cannes.

Get some new wheels

If you’re moving to the French Riviera, you’ll want to purchase a scooter or motorbike as well as a car.

Driving during rush hour is hectic on the south coast so a ‘deux roues’, as they call them in France, is the perfect vehicle for nipping in and out of the traffic. Safely, of course!

Scooters aside, head to Monaco if you’re in the market for a supercar. There are several supercar showrooms in the Principality including Ferrari, Lamborghini, Maserati, Bentley, and if you like your cars shaken but not stirred, Aston Martin.

Driving in France

The French drive on the right-hand side. If you’re used to driving on the left it may take some getting used to that. Usually, within 3 months of living in France, you get the hang of it and will no longer have scary moments pulling out of junctions on the wrong side of the road!

To legally drive in France you must be at least 18 years old and have a valid driving licence (permis de conduire). Be sure to carry your licence with you at all times in case you are asked for it at a random stop. Police controls are not uncommon in the area.

If you intend to stay in France indefinitely, you’ll be encouraged to get a French driving licence.

If your licence was issued outside France, it will fall into one of these categories:

1. May be used in France or exchanged for a French one (applies to all EU-issued licences – conditions apply).

2. Must be exchanged within one year of residency in France.

3. May not be exchanged. The holder must undergo a full driving test (theory and practical) in order to get a French driving licence.

Find out the exact steps to follow if you have to (or would like to) exchange your foreign driving licence for a French one here: Exchange driving licence.

Getting to know the area

The French Riviera is peppered with hot spots to explore. Even after living in the area for 3 years, you’ll still find new areas to enjoy and new stones to uncover.

Azur Vibes is a local destination guide which showcases the best things to see and do in the area. Otherwise, head to the local tourist information centres, talk to the locals and just get out and explore for yourself.

Noteworthy places to visit are of course the main hubs of St Tropez, Cannes, Antibes, Nice and Monaco. Other beautiful villages include Vence, Eze, Saint Jean Cap Ferrat, Villefranche, Mougins, Grasse, the list goes on.

If you’re moving to the French Riviera you’ll have plenty of time to see all of these stunning places.

Getting around

There are heliports up and down the coastline if you’re in a rush. Otherwise, private chauffeur like Kingdom Limousines is a great option for moving around the Riviera. Uber exists in France, but only the Uber X, Berline and Van versions.

Call an Uber: Sign up

Alternatively, you could use the trains. The rail journey along the coast is breathtaking. The train service leaves something to be desired, though. They are not always on time and often on strike.

Car is always an option but avoid the main hubs during rush hour. If you have to venture out around 9am and 6pm, take a scooter or motorbike and beat the traffic.

Healthcare in France

France is good for many things, and the excellent healthcare is definitely one of them.

As explained by expatica.com, the French healthcare system covers both public and private hospitals, doctors and other medical specialists who provide French healthcare to every resident in France regardless of age, income or status.

This makes the French healthcare system highly accessible, even for foreigners. Additionally, the majority of French healthcare costs are covered by the state via a public French healthcare insurance scheme.

It is compulsory for residents in France to register with a French health insurer, as well as to register with a doctor in France and go through this doctor for most treatments, or referrals to specialists, in order to be properly reimbursed by the French healthcare system.

Find out more: A guide to the French healthcare system

International Schools on the French Riviera

If you’re bringing a young family to the South of France, you’ll be pleased to know there are some very good international schools in the area.

If you’re moving to Monaco, the ISM is a great place to school your children. The school is located right on Port Hercules in the centre of Monaco. Get in touch: +377 93 25 68 20

ISN is a short 15 minute drive from the centre of Nice and offers education programs for kids aged between 4 and 18. Get in touch: +33 (0) 4 93 21 04 00

This school is based in Sophia-Antipolis which is a business hub not far from Cannes. The International section currently follows the British Curriculum. Get in touch: +33 (0) 4 93 64 32 84

If you’re buying property in or around Cannes, Mougins school could be the best choice for

children aged between 3 and 18. Get in touch: +33 (0) 4 93 90 15 47

If you want your children to grow up bilingual, there are many French schools in the area. Some of them cover lessons in French and in other languages like English, Spanish, Italian and German. That way your kids will get the best of both worlds.

Doing Business

The main business hubs in the area are in Monaco, Nice, Sophia-Antipolis and Cannes. By attending local events you’ll soon meet the local entrepreneurs and forge business relationships and partnerships.

This Facebook group is a particularly good place to start: Riviera Entrepreneurs. Request to join the group and then introduce yourself. You’ll get a warm welcome.

Other than that, Inter Nations can be a good place to meet like-minded business people.

French Taxes

Living in France means you will benefit from the generous French social security and health systems, but of course that also means paying your taxes in France.

Depending on whether you are a homeowner or a tenant, you will either have two or three main personal taxations to pay – income tax (impôt sur le revenu); residential occupancy tax (taxe d’habitation), and property tax (taxe foncière) if you are a homeowner.

This latter taxation is paid by your landlord if you are a tenant. Obviously there are other taxes such as social security contributions (charges sociales/cotisations sociales); and tax on goods and services (taxe sur la valeur ajoutée – TVA).

If you’re selling land or property or have assets over €1.3 million, you are likely to also have to pay capital gains and wealth taxes.

The rule is that you pay tax on your worldwide income, whether it’s from employment, investments, bank interest, pensions or property.

There are tax bands and what you pay is based on your earnings as a household (foyer). You add up the earnings of everyone in the household and divide this by the number of ‘parts’ or people in the family (parts familiales).

Adults in employment count as one whole part; the first two children count as half parts and successive children count as one part. That sum is assessed against the tax bands and then multiplied by the number of ‘parts’ in the family. The result is that married or civil partnership (PACS) couples, or families with children, pay less than individuals living alone.

So who has to pay taxes in France?

1. People whose main residence is in France, or who live in France for more than 183 days per calendar year. That doesn’t have to be consecutive days.

2. People whose main occupation is in France.

3. People whose most substantial assets are in France.

Income Tax (impôt sur le revenu)

You have to fill out your tax declaration by 31st May (or June if you do it online) for the previous year. After you have done this the first time (get a form from your local tax office (centre des impôts) or mairie, or online through impots.gouv.fr) you will automatically be sent a filled out form in subsequent years to check, modify and return. Missing the deadline incurs a 10% fine of the total amount due.

Residential Occupancy Tax (Taxe d’habitation)

Every household pays an annual taxe d’habitation. Whoever is the occupier on 1 January is liable. The calculation is the combination of a percentage of the average rental cost of houses in your area (set by your commune) and your income. Payment is due before 15th November.

On the same bill there will be a sum for a TV licence (redevance audiovisuelle – currently €133) for every TV, even if you only use it to watch DVDs.

Property Tax (Taxe foncière)

If you own a property you will have to pay taxe foncière at the end of the year, even if you’re renting the property out. What you owe is based on the estimated annual rental value of the property multiplied by a percentage set by the commune.

Finding Staff/Workers

If you’re looking to recruit staff for your home or business, there are plenty of places to get the word out.

- Angloinfo Jobs – Local website

- Riviera Radio Jobline – Local radio station for English speakers

- Antibes Business & Trades – Facebook group

Conclusion

Life on the French Riviera is good, very good.

Moving to a new country is always a little daunting, but with the tips above, you should be able to make your plans without too much stress.

If you’d like help in making plans to move to France, get in touch with Beauchamp Estates in Cannes. We’d be happy to help.

Places to Live on the French Riviera